Torqeedo, the market-leading supplier of electric outboard and inboard drives for leisure boats and small fishing boats, recently surpassed 100,000 electric boat drive sales. It is a milestone which marks steady progress for the industry.

What’s remarkable about this achievement is that it has largely been met with little to no financial incentives or regulation on outboard or inland vessel emissions, which are both key drivers for other electric vehicle segments (the limited emissions regulation that does exist is highly local: a handful of lakes in Germany and Amsterdam’s central canals).

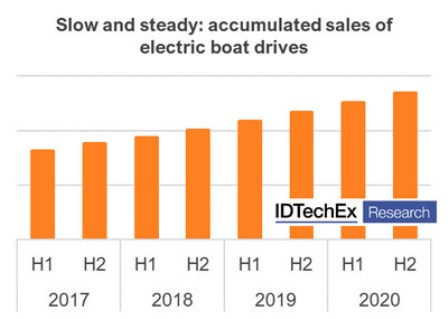

As a result, growth has been steady, but also slow and is not taking off in the same way as other electric vehicle markets like passenger cars (or even categories within the marine sector, such as offshore support vessels).

Part of the apathy towards restricting boating emissions is down to prioritizing the largest problems first. While emissions per outboard can be over 30 times the emissions per car, the scale of the problem is still much smaller: no more than 500,000 outboards are sold yearly compared with roughly 80 million cars (OICA). Still, allowing boats a free pass on emissions undermines the massive effort from other industries, and ultimately will lead to a more difficult transition down the line.

IDTechEx has just updated its popular report “Electric Leisure & Sea-going Boats and Ships 2021-2040“, which highlights some of the key challenges remaining to bring electric leisure boats into the mainstream:

- No incumbents on the market. The incumbents that make and sell the most outboards – Yamaha, Honda, Mercury – have made no moves to develop electric versions. This is common in the more niche electric vehicle categories, which are often overlooked by policymakers in favour of cars and commercial vehicles. The result is start-ups like Torqeedo have literally created and driven the electric leisure boating market almost single-handedly. This also means they have an unchallenged reign: Torqeedo’s high level of experience and developed product line-up makes it difficult for other start-ups to compete. Incumbents, backed by large balance sheets and market experience, would be the first real challenge. In short, incumbents entering the market would improve competition, improve awareness of electric boats as an option, and likely increase overall market sales.

- A lack of emissions regulation. This challenge goes hand in hand with the last point. Policymakers’ apathetic attitude towards emissions regulation for outboards and inland vessels has allowed incumbents to easily develop and sell products that increase overall boating emissions, rather than reduce it.

- High battery prices. System-level maritime battery prices are several times higher than those of other industries such as electric cars and stationary energy storage. The new IDTechEx report “Li-ion Batteries 2020-2030” gives a detailed overview of how we expect Li-ion battery prices to evolve over the next decade.

The new IDTechEx report, “Electric Leisure & Sea-going Boats and Ships 2021-2040“, provides historical data from 2016 and forecasts up to 2040 in number of electric vessels, battery demand (MWh) and market value ($ billion) broken down by pure electric and hybrid powertrain as well as by each marine sector: leisure boats, fishing, cruise ships, ferries, offshore support, tugboats and deep-sea. The report delves into key underlying technologies and draws parallels and differences with the auto industry. All results are underpinned by primary research and interviews undertaken around the globe.

This report also forms a part of the broader electric vehicle and energy storage research at IDTechEx, where we track adoption of electric vehicles, battery trends and demand across more than 100 different mobility sectors, summarised in one master report, “Electric Vehicles 2020-2030: 2nd Edition“.