The year 2020 has been a hugely challenging year for businesses around the world as a result of the global COVID-19 pandemic. The automotive industry is no exception, with lockdowns forcing the temporary closure of many production facilities. And an uncertain economic environment is negatively impacting consumer demand.

Despite the difficult financial climate, there is evidence of growing momentum in the light commercial vehicles (LCV) market. The situation is transitioning away from conventional diesel fuelled light commercial vehicles (LCVs) toward electric light commercial vehicles (eLCVs).

The past 12-months have seen a slew of eLCV models launched. And further announcements about future eLCV models are being developed both by traditional OEMs and exciting new start-ups.

IDTechEx’s new report “Electric, Hybrid & Fuel Cell Light Commercial Vehicles 2021-2041” provides a COVID-19 adjusted, 20-year outlook for the eLCV market, with separate forecast lines for battery electric, plug-in hybrid, and fuel cell LCVs, both at the global scale and for key regions: China, the US and Europe.

Forecasts are presented for eLCV unit sales, battery demand (GWh) and market value ($ billion).

The report describes the current state of the eLCV market in each of these regions; highlights the major players in the market; provides background to eLCV enabling technologies such as energy storage, electric traction motors and charging; and looks at the distinct drivers that are promoting the growth of eLCVs, including total cost of ownership (TCO) considerations.

Whilst historically the primary motivation for businesses to purchase electric commercial vehicles has been to address environmental concerns around exhaust emission and to enhance a company’s ‘green credentials’, IDTechEx argue that increasingly the motivation for eLCV uptake need no longer be environmental, but economic.

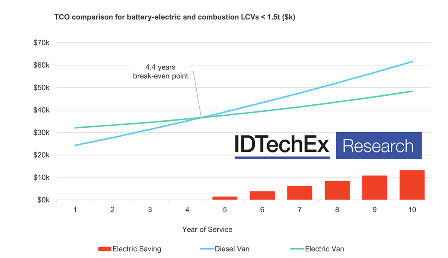

For example, the new IDTechEx report finds that even without government purchase subsidies, small electric LCVs, could reach TCO parity with a comparable diesel vehicle within 4.4 years, with the extra upfront cost of the EV powertrain offset by fuel savings (using electricity instead of diesel) and reduced maintenance and servicing.

The specific TCO calculation will vary for each potential use case and depend on location and the daily range requirement of the vehicle. But the knowledge fleet operators hold about the operation of their fleets means that the LCV market is uniquely positioned to see rapid electrification.

Whilst the financial fallout of the pandemic for economies around the world will likely result in increased price sensitivity (which given the higher upfront capital cost of EVs could put them at a disadvantage versus cheaper internal-combustion engine vehicles), for commercial vehicles purchase decisions are more commonly guided by TCO calculations, that reflect the lifetime cost of the vehicle.

Whilst the financial fallout of the pandemic for economies around the world will likely result in increased price sensitivity (which given the higher upfront capital cost of EVs could put them at a disadvantage versus cheaper internal-combustion engine vehicles), for commercial vehicles purchase decisions are more commonly guided by TCO calculations, that reflect the lifetime cost of the vehicle.

Fleet operators hold a wealth of information about their LCV daily duty demands, fuel consumption and maintenance costs, which enables robust TCO analysis to be conducted. The cost saving advantage of switching from diesel to eLCV will be clearer to fleet managers than private consumers.

IDTechEx believe that well before the end of the decade, in many regions, eLCVs, from small LCVs through to large 3.5 tonne LCVs, will be more cost effective for operators than diesel fuelled models.

Large companies are increasingly moving on from pilot scale projects to the replacement of significant numbers of vehicles within their fleets with electric LCVs. Some recent examples include: UPS ordering 10,000 eLCVs from UK start-up Arrival; British Gas ordering 1,000 Vivaro-e LCVs from Vauxhall; and Amazon placing an order for 1,800 eLCV with Mercedes. This reflects IDTechEx’s position that TCO considerations already work in favor of eLCVs in certain scenarios.

©Copyright MOTORING WORLD INTERNATIONAL.

All rights reserved. Materials, photographs, illustrations and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior written permission from Motoring World International

Contact: [email protected]