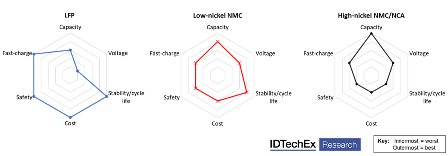

Due to their applicability in electric vehicles and stationary storage, Nickel-manganese-cobalt oxide (NMC) and nickel-cobalt-aluminium oxide (NCA) layered-oxide materials are the dominant cathode of today

In current iterations, nickel can make up to 60-80% of the metal content. To improve these class of materials, many have been attempting to incorporate more nickel into these cathodes, which increases their reversible capacity and can replace some of the expensive cobalt needed.

Increasing capacity, and therefore energy density, is of course highly important for battery electric cars. and IDTechEx forecast the share of “high-nickel” NMC (60% nickel) to increase significantly over the next decade.

Increasing capacity, and therefore energy density, is of course highly important for battery electric cars. and IDTechEx forecast the share of “high-nickel” NMC (60% nickel) to increase significantly over the next decade.

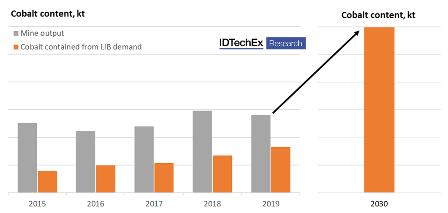

Recently, motivation is shifting toward lowering cobalt content in and of itself to minimize the dependence on the controversial material. IDTechEx calculate the amount of cobalt contained in Li-ion by 2030 to be nearly 300 kt. This will be a 2x increase the amount that was estimated to have been mined in 2019, according to USGS data.

The 5-10 year timeframes needed to build new mines suggests that transport electrification and renewable integration may well be at risk of material shortages.

More information can be found IDTechEx’s report “The Li-ion Supply Chain 2020-2030“. Therefore, the move away from cobalt is desirable from a number of perspectives and numerous companies and news items report the advent of low-cobalt and cobalt-free batteries.

However, the metal is generally considered to be critical for stabilizing NMC/NCA materials and reducing cobalt content below 10% without severely degrading cycle life and safety is no small feat. So what are the options for moving away from cobalt containing cathodes?

NMC/NCA – First, there is the overarching trend to decrease the cobalt content of NMC and NCA. And while they are unlikely to ever be zero-cobalt, efforts continue by many to minimize cobalt and increase nickel content.

As noted above, the challenge comes with preserving cycle life and stability. And numerous material choices and designs are being employed to improve these factors.

NMC 811 (80% nickel) is reported to be in use in several Chinese EVs and the increase in nickel content is set to continue with patent literature showing that major players are using and exploring materials with nickel content above 80%; see the IDTechEx report “Li-ion Battery Patent Landscape 2020“.

Reducing cobalt and increasing the nickel content of layered oxides will likely be the go-to solution for increasing capacity and reducing cobalt reliance even if they’re never quite zero-cobalt.

NMA : A recent paper out of U Texas (DOI: 10.1002/adma.202002718) showed promising results for a zero cobalt layered oxide cathode. While there was a decrease to capacity (and therefore energy density) the stability of the material over cycling, both at 25 °C and 45 °C was surprisingly high.

Higher temperatures can be reached in demanding applications such as EVs. And stability of their NMA material will need to be demonstrated, given the generally higher rate of manganese dissolution, especially at higher temperatures. A potential long-term solution for excluding cobalt but limited capacity improvement limits performance benefit over current state-of-the-art.

Higher temperatures can be reached in demanding applications such as EVs. And stability of their NMA material will need to be demonstrated, given the generally higher rate of manganese dissolution, especially at higher temperatures. A potential long-term solution for excluding cobalt but limited capacity improvement limits performance benefit over current state-of-the-art.

LFP: A widely commercialized technology that can demonstrate long cycle life, improved safety and can be designed for high rate capability.

In addition, it is a relatively low-cost material on a $/kg basis. As a result of these factors, it is well suited for applications such as electric buses, two-wheelers, certain stationary applications and has received renewed interest for electric cars as well.

However, it is an intrinsically lower energy density cathode and while there are ways to improve energy density at both the cell and pack level, LFP batteries is unlikely to be sufficient for long-range electric cars.

LMP/LMFP: Lithium-manganese-phosphate (LMP) shares the same crystal structure as LFP but operates at a more positive voltage, overcoming one of the key disadvantages of LFP.

However, cycle life tends to be low, due to the high manganese content, while poor electronic and ionic conductivity mean that reasonable capacities are generally only measured at low charge/discharge rates, making them unsuitable for EVs.

The addition of Fe to form LMFP can improve conductivity and cycle life but lowers the average voltage. Ultimately, LMFP may bridge the gap between LFP and NMC/NCA but the reversible capacities of LMP and LMFP are too low to reach the cell level energy densities of cells using NMC or NCA.

LNMO : Lithium-manganese-nickel oxide (LNMO), separate from the NMC/NCA/NMA layered oxides, is a cathode that operates at a high voltage of 4.7 V vs Li/Li+, up to 25% higher than NMC. It has also shown promise as a high rate material. Unfortunately, improvements to energy density are effectively lost due to LNMO having a comparatively low capacity of around 120 mAh/g.

While the high operating voltage will require developments to the electrolyte to ensure stability and safe operation. Cell level energy density improvements are unlikely, but the higher voltage could allow for battery pack level cost and performance benefits so long as electrolyte stability can be demonstrated.

Li and Mn-rich (LMR-NMC): A cathode that is not necessarily cobalt free but can reduce cobalt content compared to current NMC and also lower cost through comparatively high Mn content. The material is one of only a few options for significantly improving the capacity of Li-ion cathodes.

LMR-NMC can exhibit a 20-30% capacity improvement over current state-of-the-art NCA but is plagued by cycle life and stability issues, another long-term project and example of the often-seen trade-off between high energy density and cycle life.

The Li-ion market is continuously pushing for new technology developments with the drive to lower the cobalt content of NMC and NCA cathodes gaining considerable recent attention.

However, doing this without negatively impacting overall performance is highly challenging. And cost benefits are not guaranteed, given the relatively low percentages of cobalt already used in state-of-the-art cathode formulations and the increased difficulty of synthesizing low-cobalt/high-nickel layered oxides.

Other classes of cathode materials come with their own list of pros and cons. Of course, the ethical impacts of cobalt mining should not be understated. And there is likely to be a need for companies to minimize their need for the metal in the medium-long term to reduce supply risks.

As is hopefully made clear in this article, there is no ‘silver bullet’ cathode technology. And as such, there will continue to be differentiation in the solutions adopted, dependent on market, application, and customer preference. Find out more on the latest cathode technology and market developments in the report “Li-ion Batteries 2020-2030“.

©Copyright MOTORING WORLD INTERNATIONAL.

All rights reserved. Materials, photographs, illustrations and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior written permission from Motoring World International

Contact: [email protected]