By the end of 2019, a total of 1,119 plug-in electric vehicles had been sold in South Africa, of which 545 were Battery Electric Vehicles (BEV) and 574 Plug-in Hybrid Electric Vehicles (PHEV).

With air pollution one of the biggest threats to human health – and 90% of the global population breathing unsafe air – accelerated Battery Electric Vehicle deployments in world markets target poor air quality within cities, combating increasing direct and indirect respiratory-linked deaths due to the combustion of petrol/diesel across the transport sector. Electric vehicles not only have zero tailpipe emissions but are also significantly more energy-efficient (up to 60% more) and lower total cost of ownership when compared to traditional petrol/diesel vehicles.

The COVID-19 pandemic currently has cities worldwide in lockdown and actions taken to limit human movement have resulted in a signification reduction of pollution, specifically emissions from the transport sector. The lockdowns have additionally allowed us to re-think many life aspects while embracing opportunities that emerging technologies present during these unprecedented times. As and when life begins to normalise, post-COVID-19, we need to reflect on the impact we’ve been having within our cities, perhaps re-think condoning a return to the pollution levels which have impacted each citizen – young, old, low and high income – with the air we breathe being our common denominator.

The State of Electric Vehicles report reviews four focal points related to electric vehicles – Air Quality, Manufacturing, Imports, Charging Infrastructure and Government Policy.

Air Quality

Air pollution, referenced as a silent killer, continues to pose one of the most significant global threats to human health, with World Health Organization estimates indicating it is responsible for around 7 million deaths annually.

More than 80% of the world’s population live in urban areas where pollutant levels exceed WHO guideline limits. Air pollution has a significant impact on human health, increasing risks of respiratory diseases, heart disease, lung cancer, and low birth weight (among others). Children and the elderly are particularly vulnerable, placing an even greater burden on the healthcare system with substantial medical costs.

Vehicle manufacturers face growing pressure from strict emission regulations being enacted worldwide to combat the impact of petrol/diesel vehicle-related emissions. Alongside the limitations of these traditional powertrain technologies, global advancements in battery technologies have driven exponential growth of battery electric vehicles worldwide resulting in cities initiating the banning of petrol/diesel vehicles to improve air quality within the urban environment.

Along a reference of ‘carbon footprint’ as a measure of how polluting a city or country is, the Norwegian University of Science and Technology (NTNU) developed a Global Gridded Model of Carbon Footprints (Scope 3 emissions). Amongst the Top 500 Carbon Footprints of World Cities, i.e. world’s most polluted cities, South Africa’s ranking sees Johannesburg ranked 13th globally (Domestically 1st), Cape Town is 89th (Domestically 2nd), Durban is 102nd (Domestically 3rd), and Port Elizabeth 335th (Domestically 4th).

The Department of Transport Green Transport Strategy (GTS) launched in 2018 identified road transport in South Africa as being the primary source of transport-related CO₂emissions, contributing to 91.2% of total transport greenhouse gas emissions, primarily from the combustion of petrol and diesel. Compounding this is the fuel quality distributed within South Africa is at Euro 2 level (globally introduced in 1997), while many countries worldwide are at Euro 5 and 6 levels. An earlier study revealed that South Africa’s transition from Euro 2 to Euro 6 fuels would decrease greenhouse gas emissions by just 12%. A transition to Electric Vehicles, while charging through the existing energy mix would reduce emissions by 34%. Charged by a zero-carbon mix Electric Vehicles would reduce South Africa’s greenhouse emissions by 67%.

According to the International Energy Agency (IEA) transportation is responsible for almost one-quarter of direct CO₂ emissions from fuel combustion, hence the need for decarbonised transport.

Automotive Manufacturing

As a historic reference of the automotive manufacturing industry in South Africa, it has existed since the first production plant began assembly of the Model T Ford in February 1924, making 13,000 units in that year. In 2019, 631,983 vehicles were manufactured locally with and the automotive industry contributed 6.9% to Gross Domestic Product (GDP), and total automotive revenue amounting to R503 billion. In terms of employment, the manufacturing segment of the industry presently employs more than 110,000 people from component manufacturing to vehicle assembly.

The growth of the automotive manufacturing industry has leveraged off government’s production incentive schemes for the automotive industry aimed at promoting production volumes, added value in the automotive component industry and creating employment across the local automotive value chain. Passenger car manufacturing plants within South Africa include BMW, Ford, Mercedes Benz, Nissan, Toyota and Volkswagen – all centred to traditional powertrain technologies of petrol/diesel. Late in 2016, Mercedes Benz South Africa was the first locally to advance into alternative technologies with the manufacturing of the C-Class Plug-in Hybrid Electric Vehicle variant at the East London plant.

In terms of government’s production incentive schemes the Automotive Production and Development Programme (APDP) implemented in 2013 and ending in 2020, has had no direct incentive for South Africa’s competitive edge for alternative technologies in keeping aligned to global automotive technology advancements. While some reviews have been done of the scheme to assess its impact, options to deal with identified gaps in competitiveness and ensuring support to the industry is consistent with South Africa’s multilateral obligations and domestic priorities, a review remains on how much longer we can still maintain, and even grow global market share.

With many cities and countries worldwide announcing plans for the banning of petrol/diesel vehicles, we need to review the market longevity of the vehicles manufactured locally. As 60% of vehicles manufactured in South Africa are exported to the European Union – and many of these countries implementing the referenced bans of fossil fuel from as soon as 2025, will our fellow African states need to become the ‘dumping ground’ for South African-built petrol/diesel vehicles in future? African countries could also be pro-active in joining the global climate action movement and leapfrog into embracing Electric Vehicles, capitalising on abundant renewable energy and offset imports of fossil fuels.

The South African Automotive Masterplan (SAAM) replaces the APDP from 2021 through to 2035 and includes targets of achieving 1% of global vehicle production by 2035 while increasing local content from the existing 39% to 60% as well as doubling employment in the value chain. SAAM quotes Energy Efficient Vehicles (EEV) will comprise 35% of the global market by 2040 with Electric Vehicles dominating the basket of EEV’s. However, there is only a reference of an Energy Efficient Vehicle Technology Road Map, with no direct technology incentive outlined for South Africa to capture global EV market share.

Complete Built-up Unit Imports

As South Africa does not manufacture battery-electric passenger vehicles locally, importers must source from international markets. On review of the landscape of electric vehicle local market introductions, the first Hybrid Electric Vehicle introduced in South Africa was the Toyota Prius in 2005, the first Battery Electric Vehicle was the Nissan Leaf in 2013, and the first Plug-in Hybrid Electric Vehicle was the BMW i8 in 2015. To date, there are no Fuel-Cell Electric Vehicles sold locally.

For technology context, Hybrid Electric Vehicles have an on-board battery pack charged from the petrol/diesel engine and the electric drive provides some supplement of the energy required for mobility. Plug-in Hybrid Electric Vehicles have a larger battery pack that can be charged from an external electricity source and the electric drive provides a larger energy contribution for mobility. Battery Electric Vehicles are 100% electric drive with large battery packs that provide all the energy required for mobility and are charged externally from any available electrical supply. Fuel-Cell Electric Vehicles use hydrogen as the energy source, relying on dedicated hydrogen re-fuelling infrastructure. By the end of 2019, there were 28 model derivatives of Hybrid Electric Vehicles across a total of 4,924, 10-variant Plug-in Hybrid Electric Vehicle models from BMW, Land Rover, Mercedes Benz and Volvo to a 574 total. In terms of Battery Electric Vehicles, the models sold to up to the end of 2019 include the Nissan Leaf (94 units), BMW i3 (405 units) and Jaguar iPace (46 units) to a 545 total. On electric driving range (WLTP combined) the BMW i3 provides 300 km and the Jaguar iPace 470 km range.

Price parity for battery electric vehicles with their petrol and diesel counterparts is forecast to occur by 2023, as manufacturers accelerate production output to meet consumer demand. This will impact the two key market determinants for Electric Vehicles, affordability and pricing. As South Africa is reliant on internationally sourced electric vehicles, low sales locally are a reflection on the current tariffs within the automotive policy regime. The European Union is South Africa’s largest trading partner and the SA-EU Economic Partnership Agreement (EPA) governs trade relations and development co-operation on bilateral trade in the current framework until October 2022. Under the current tariff structure, petrol/diesel passenger vehicles manufactured in the EU and imported into South Africa attract 18% Customs Duty, where electric vehicles attract 25%. This is an immediate 7% pricing barrier on electric vehicles within South Africa. Additionally, structured within the recommended retail price of the vehicle, is the Ad Valorem Customs and Excise Duties calculated against the Customs value of the vehicle – and the addition of Value-Added Tax. On markets outside the EU, the Customs Duty of 25% is applicable across all types of vehicles – petrol/diesel/electric.

Charging Infrastructure

Low sales of Battery Electric Vehicles are also attributed to consumers’ perceived anxiety on the lack of public charging stations. From use cases worldwide, predominantly 60 – 70% of EV charging takes place at home, typically overnight. Electric Vehicles are also supplied with a convenience charging cable that allows charging from any standard residential outlet like other home appliances providing the convenience to charge from existing electricity supply outlets within homes and businesses. Faster charging rates are achieved from public chargers and, depending on the vehicle and charger rating, typical charge times vary from 25 minutes to 6 hours. Charger ratings are usually matched to the time frames of consumer parking at the specific location, and some locations may be strategically planned for fast charging, typically on and off highways or shopping malls within the city.

Standardisation is a key aspect for the market and adhering to standards provides broader flexibility for industry and consumers, even while new technologies evolve. The South African National Standards (SANS) adopted for the country’s Electric Vehicle charging infrastructure include ‘Type 2 socket for AC charge points’ (SANS 62196-2), and “CHAdeMO and Combined Charging System 2 for DC (fast) charging (SANS 62196-3), independent of the current Electric Vehicle model presence. These adopted standards provide market interoperability, rather than exclusivity, and are aligned to international market norms.

While Electric Vehicles consume grid energy during charging, through the supporting technology within the vehicle and equipment, the large internal battery packs can provide ancillary grid services through Vehicle-to-Grid and also supplement energy within homes through Vehicle-to-Home. Communication systems contained within Electric Vehicle charge points provide location, availability, energy profiling and options for reservations. Services provisions in each market should promote interoperability over exclusivity control, with specific alignment to international protocols such as the Open Charge Point Interface (OCPI).

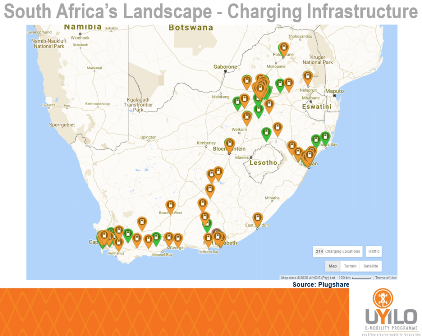

South Africa has an active footprint of public charge points enabled by multiple initiatives. Through the international community-based platform PlugShare, South Africa lists approximately 214 public chargers across the country, predominantly across specific locations within cities and major highways. As an energy capacity forecast, along a simulated model of energy supply in South Africa and using the average 5% global electric vehicle fleet match in South Africa, it would correlate to approximately 0.5% of peak energy demand. South Africa’s electric vehicle car park currently stands at 0.009%.

Government Policy

As a signatory to the Paris Agreement under the United Nations Framework for Climate Change Convention adopted in December 2015, South Africa is committed to a “peak, plateau and decline (PPD)” emission trajectory through its Nationally Determined Contributions. The National Climate Change Response Strategy is a supporting policy document guiding climate change response across all departments.

While some policy instruments have been implemented along with the ‘carrot-and-stick’ approach, the respective revenue accrued within the fiscus through these instruments is not applied to the corresponding climate change actions. Some of the policy instruments relating to addressing transport emissions include:

Environmental CO2 levy: Penalise the buyers of vehicles with high CO2 emissions

Fuel Levy: Raises the cost of petrol and diesel to promote greener alternatives

Fuel economy and CO2-labelling: Allows consumers to make model-to-model comparisons of fuel economy and CO2 emissions between cars to promote greener alternatives

Carbon Tax: Gives effect to the polluter-pays-principle for large emitters and helps to ensure that firms and consumers shoulder the adverse costs

Broader policy frameworks need to be aligned towards addressing the global climate action within the context that South Africa faces the challenge of climate change as a developing country, with priorities to reduce poverty and inequality. Climate Action Tracker, an independent scientific analysis that tracks government climate actions and measures them against the globally agreed Paris Agreement lists “as of December 2019” under the currently implemented policies and continued low economic growth, South Africa’s actions are “Highly Insufficient” and not consistent to holding climate warming to below 2°C let alone the Paris Agreement’s stronger 1.5°C limit.

South Africa is lagging behind worldwide efforts to accelerate Electric Vehicles into all markets, both from local manufacturing competitiveness and a local car park that will address the poor air quality that makes children and the elderly particularly vulnerable and placing an even greater burden on the healthcare system. The required accelerated efforts need to be collaborative with government, industry and the citizens.