electric motors truly are the driving force behind electric vehicles (EVs). In addition to the batteries and power electronics, the electric motor is a critical component within the drivetrain.

IDTechEx, a UK-based research company, expects over 100 million electric motors to be required per year by 2032 to meet the demand for the growing EV market.

Despite electric traction motors originally being developed in the 1800s, the market is still evolving today with new designs, improved performance and more considerations around the materials used. These are not just incremental improvements either, with developments such as axial flux motors and various OEMs eliminating rare-earths altogether.

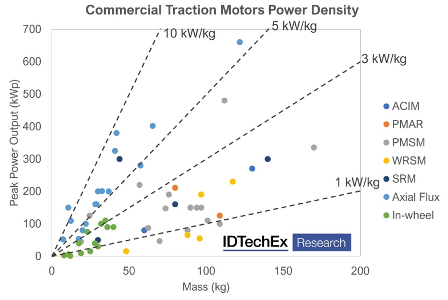

There are several key performance metrics for electric motors. Power and torque density enables improved driving dynamics in a smaller and lighter package, with weight and space being at a premium in EVs. Another critical area is efficiency.

Improving efficiency means that less of the precious energy stored in the battery is wasted when accelerating the vehicle, leading to improved range from the same battery capacity. Due to the many different considerations in motor design, the EV market has adopted several different solutions including permanent magnet, induction, and wound-rotor motors.

In many cases, a combination of options may be used to give the best overall solution. Each has its own pros and cons in terms of performance but also in terms of materials costs and supply, with permanent magnet motors relying on rare earths with volatile pricing and a geographically constrained supply chain.

Axial Flux, In-wheel, and Other Emerging Options

A key emerging motor technology is that of axial flux. The magnetic flux is parallel to the axis of rotation in an axial flux motor (compared to perpendicular in radial flux machines). Whilst almost the entire EV market is using a form of radial flux motor, axial flux motors present several benefits. These include increased power and torque density and a pancake form factor ideal for integration in various scenarios.

Despite the previous lack of adoption, the technology has evolved to the state where we have seen significant interest. Daimler acquired key players YASA to use their motors in the upcoming AMG electric platform and Renault has partnered with WHYLOT to use axial flux motors in their hybrids starting in 2025. The axial flux market in automotive EVs is very small today but IDTechEx expects a huge increase in demand over the next 10 years, with first applications in high-performance vehicles and certain hybrid applications.

DTechEx also sees some promising applications for other alternatives to typical EV motors such as in-wheel motors and switched reluctance motors. In-wheel motors can eliminate much of the drivetrain components that would normally take up space within the cabin of the vehicle and provide benefits such as torque vectoring. Lordstown announced the use of Elaphe’s in-wheel motor for its electric trucks and other players like Protean are providing in-wheel motors to autonomous shuttles.

Switched reluctance motors are by no means a new technology, but are making somewhat of resurgence in certain segments with improvements to their design and control.

Advanced Electric Machines (AEM) is providing commercial vehicles and developing a motor with Bentley.

Switched reluctance machines are much simpler to manufacture than many others and utilize no rare earths, in fact, some like AEM and RETORQ motors are moving to aluminum windings in order to avoid copper.

The new report from IDTechEx, “Electric Motors for Electric Vehicles 2022-2032”, details OEM strategies, trends and emerging technologies within the motor market for EVs.

An extensive model database of over 250 EV models sold between 2015-2020 aids in a granular market analysis of motor type, performance, thermal management, and market shares.

Technologies and markets are considered for cars, two-wheelers, light commercial vehicles (vans), trucks, and buses along with several use-cases and benchmarking.

Emerging technologies are also addressed with market forecasts through to 2032 such as axial flux and in-wheel motors.

©Copyright MOTORING WORLD INTERNATIONAL.

All rights reserved. Materials, photographs, illustrations and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior written permission from Motoring World International

Contact: [email protected]