in countries where Electric Vehicles (EVs) are gaining popularity, Plug-in EVs are approaching an inflection point, as battery costs fall, driving range improves and consumer awareness and acceptance increases.

But larger batteries and longer range alone is not going to address range anxiety for consumers: broader access to charging infrastructure is one of the key factors to convincing consumers a pleasant driving experience awaits.

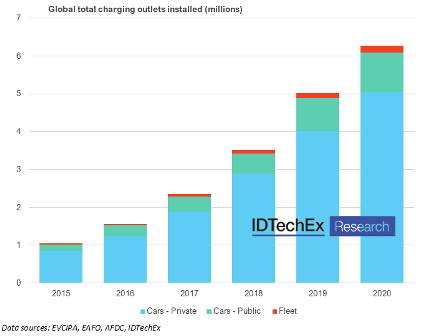

IDTechEx Ltd, a Cambridge, UK-based research firm, estimates the global plug-in electric vehicle (BEV + PHEV) population reached 8.1 million units (including light commercial vehicles) by the end of 2019, supported by roughly five million charging outlets.

According to it, there will be over 111 million plug-in EVs in-use globally by 2031: a massive driver for the wide-spread deployment of charging infrastructure.

In addition to consumer-driven demand, regulatory support is also gaining momentum. For example, while China – the world’s largest electric vehicle market – has been decreasing its subsidies for purchasing EVs, it is increasing incentives for developing charging infrastructure.

The new IDTechEx report “Charging Infrastructure for Electric Vehicles and Fleets 2021-2031” finds that the market for charging infrastructure will be worth $65 billion per year by 2031, even after the losses from covid-19.

The new IDTechEx report “Charging Infrastructure for Electric Vehicles and Fleets 2021-2031” finds that the market for charging infrastructure will be worth $65 billion per year by 2031, even after the losses from covid-19.

Electric passenger cars, buses, trucks and vans are the most relevant sectors, but each has very different charging needs in terms of delivery method and power requirements. As a result, the report finds that although electric fleet charging represents roughly 3% of the total charging infrastructure in volume, it constitutes over 20% of the total market value, creating tremendous opportunities for players along the EV charging value chain.

Furthermore, the report finds that demand for EV charging infrastructure varies dramatically by region. In China, the adoption of private residential charging is much lower because there are few single-family homes that have access to private charging. Public charging has been and will be the dominant charging solution in China.

In contrast, the US relies heavily on private charging, which will remain the primary charging option, with public charging being more complementary.

This report forms part of the broader electric vehicle and energy storage research from IDTechEx, who track adoption of electric vehicles, battery trends and demand across more than 100 different mobility sectors.