In this report, IDTechEx analysts take a look back at the key events and trends from the future mobility world over the past year – and what to look out for in 2022

Big Market Splashes: Tesla the Tech Giant, Huge IPOs & SPACs

If there is one thing you have heard about electric vehicles this year, it has probably been about Tesla reaching tech-giant status. In November 2021, Tesla surpassed a $1000,000,000,000 market cap, driven by a slightly confused order from Hertz for 100,000 full-price Tesla electric cars (contracts were apparently unsigned while deliveries began).

More generally, Tesla’s stock is high because investors are betting on the company’s potential. Despite its huge achievements, Tesla is still only at the beginning of its S-curve.

Today, Tesla is hitting sales targets (approaching 1 million car sales in 2021) and demonstrating it can turn a consistent profit. Tomorrow its new giga-factories will help it reach its goal to sell 20 million cars annually by 2030 (more than a fifth of global car sales today).

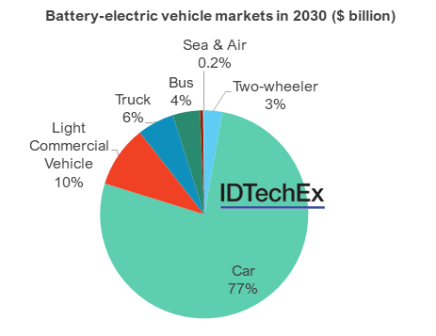

Assuming an average of $30k per Tesla car, reaching even a quarter of this equals revenues of $150 billion – a third of the $450 billion plug-in electric car market predicted by IDTechEx in 2030 (www.IDTechEx.com/EV). This is without considering its growing energy business or the potential of future technologies, such as autonomy.

While Tesla is also working on electric trucks, IDTechEx expects passenger cars to remain the most profitable electric vehicle market now and in the future, and the main driver for Tesla’s growth.

Tesla’s successes are paving the way for others. Rivian, backed by Ford and Amazon, became public early in November 2021 to the tune of $93 billion. Hundred-year-old Ford’s stock has been rallying itself this year, but its market cap still sits below Rivian’s at $77.7 billion.

Rivian’s traditional IPO rode against the SPAC trend opted for by numerous others (SPACS can be viewed as easier with less valuation risk than a traditional IPO). SPAC IPOs have been across the board in terms of company type, and this is no exception within the electric vehicle industry: from charging infrastructure companies (Tritium) to vehicle makers (Lucid Motors, Nikola) to electric sky taxis (Lilium). The results have been mixed – both disastrous (Nikola) and successful.

What is clear is there has and will continue to be plenty of drama around electric vehicle start-ups moving into 2022 as they continue to generate massive interest and hype, ill-founded or not, and make and break fortunes.

Autonomous Vehicles Levelling Up

Autonomy and self-driving cars have seen some big changes over the past couple of years. In 2021, more robotaxi trials have started offering driverless rides to the public, for example, AutoX in China, and more can be expected to start in 2022. Germany is now allowing level 4 driverless services on its road and in 2022 we are expecting to see more roboshuttle projects and more trials of robotaxis.

Private-driven autonomous vehicles have also seen some breakthroughs this year. Tesla have dropped radars from their autonomous sensor suite while continuing to make progress with a camera-only setup.

Elsewhere, Honda have launched the first level 3 vehicle in Japan in the form of the Legend. Only 100 Honda Legends were made available to lease, however, models from other manufacturers are likely to come in 2022. IDTechEx is also expecting the emergence of level 3 private vehicles in Europe, with Germany, France, and England all expressing interest in allowing their use on public roads. This will likely come to the luxury market first with the Mercedes S-Class being a favorite to be first to offer the tech early next year.

The technical progress made by the OEMs in bringing level 3 cars to market is supported by the growing sophistication of sensing technologies. Radars are becoming more and more capable, with Continental and ZF bringing the first 4D imaging radars into production vehicles in 2022.

LiDAR prices are also continuing to fall, with Bosch telling IDTechEx that their LiDAR will be available for $250-$500. These progressions offer OEMs the robustness and performance required for higher levels of automation at a series production-friendly price point.

The IDTechEx report “Autonomous Cars, Robotaxis & Sensors 2022-2042 forecasts uptake of autonomous cars by level, as well as the evolving sensor needs per vehicle type: camera, radar, LiDAR, and more.

Increased Bets on Heavy-Duty Fuel Cell Vehicles

Hydrogen fuel cells have low prospects in cars due to high cost, expensive hydrogen refueling infrastructure which has ‘not manifested itself’, high hydrogen fuel prices, and questionable emissions reductions if green hydrogen is not used. This was reflected earlier this year as Honda crashed out of the fuel cell car market.

However, the range and refueling advantage for fuel cell electric vehicles mean that heavy-duty applications, such as long-haul trucking or high mileage bus operations, have long offered a potential use for the technology, and progress has been building in 2021.

As the Tesla Semi is increasingly delayed to prioritize batteries for more profitable electric cars, in September 2021 Hyundai announced it would develop fuel cell variants for all its commercial vehicles by 2028.

Hyundai is currently conducting commercial trials in Switzerland with a fleet of 46 FCEV trucks, with plans to increase this to 1,600 trucks by 2025. They have also announced upcoming FCEV truck projects in the US and orders for 4,000 FCEV trucks in China.

Furthermore, there is also uptake for FCEVs in the bus market, with more than 150 fuel cell buses operating in Europe, 65 in the US, and more than 3000 in China. A growing order book for FCEV buses suggests demand is increasing, at least to a pilot-scale level of testing.

To learn more, the IDTechEx report “Fuel Cell Electric Vehicles 2022-2042” explores fuel cell vehicle deployment and growth in heavy-duty sectors over a 20-year period.

Emerging Electric Vehicle Tech to Watch in 2022 (Non-Battery)

There are many avenues to improving electric vehicle ranges. Looking beyond brute force battery capacity increases, key areas are vehicle power electronics (inverters, converters, onboard chargers) and electric traction motors.

Axial-flux Motors

An emerging motor technology which has gathered momentum this year has been axial flux motors, so named because the magnetic flux is parallel to the axis of rotation (compared to perpendicular in radial flux machines).

Whilst almost the entire electric vehicle market is using a form of radial flux motor, axial flux motors present several benefits. These include increased power and torque density and a pancake form factor ideal for integration in various scenarios, from cars to aircraft.

The technology reached milestones in 2021. Aftermarket leader YASA struck the first major axial-flux motor deal to supply Ferrari in late 2019, it was acquired by Daimler in July 2021 for use in the upcoming AMG electric platform. In July 2021, Renault also partnered with WHYLOT to use axial flux motors in their hybrids starting in 2025. Other innovative companies, such as Magnax, have yet to establish major supply deals (see our IDTechEx subscriber profile on Magnax).

The axial flux market in automotive EVs is very small today but IDTechEx expects a huge increase in demand over the next 10 years, with first applications in high-performance vehicles and certain hybrid applications.

IDTechEx forecast a large increase in demand for automotive axial flux motors in “Electric Motors for Electric Vehicles 2022-2032“.

Silicon Carbide Power Electronics and Sintered Die-attach Materials

In power electronics, the transition to silicon carbide MOSFETs and high voltage systems above 800V has been increasing in pace in 2021.

Renault, BYD, and Hyundai all announced new 800V vehicle platforms which will adopt silicon carbide MOSFETs in their power electronics through 2025.

Moreover, with the Mach E release in late 2021, Ford joined the likes of Tesla, BYD, and Toyota (the Mirai) in having a model containing silicon carbide power electronics available on the market.

The transition is presenting fresh challenges for power module package materials, as higher switching frequencies, increased power densities, and increased operational temperatures are expected all whilst maintaining a 15-year service life.

The transition is presenting fresh challenges for power module package materials, as higher switching frequencies, increased power densities, and increased operational temperatures are expected all whilst maintaining a 15-year service life.

As the power density of electric vehicle inverters has been increasing exponentially over the past decade, new double-sided cooling designs, copper wirebonds, and lead frames have emerged.

Perhaps most critically, as junction temperature requirements have approached 175 – 200 degrees, the limits of conventional solders have made way for novel die-attach materials.

Nano silver-sintered materials and copper sintered materials have a high melting point compared with traditional tin-based lead-free solders, and support high thermal temps above 250 degrees, helping maximize the transition towards power-dense silicon carbide MOSFETs.

While nano silver sinter pastes are on the market (e.g. Alpha’s Argomax), higher-performing copper sintered materials are still around the corner, with companies such as Hitachi, Showa Denko, and Mitsui demonstrating the technology and/or in the final qualification stages for the automotive industry.

More information and forecasts with commentary can be found in the IDTechEx report “Power Electronics for Electric Vehicles 2022-2032”.

Thermal Management in Cell-to-pack Designs

Thermal management for EVs continued to be a hot topic in 2021. The continued arc of Chevrolet’s Bolt recall seems to have come to an end with an approximate cost of $1.9 billion thanks to manufacturing defects in the cells supplied by LGChem. Whilst this story may be concluding, Li-ion batteries always present a non-zero risk of thermal runaway. This means there is a requirement to keep cells at their optimal operating temperature, but also to provide fire protection materials in case of thermal runaway.

A critical trend that will impact material suppliers in this space is the adoption of cell-to-pack technology. BYD has their Blade battery on the road and we have now seen announcements from many automakers including Tesla, VW, and Stellantis with plans to adopt cell-to-pack technology in the coming years. Cell-to-pack removes the modules and stacks all of the cells together into one large pack. This improves energy density, manufacturing complexity, and costs. However, it creates challenges around fire protection and transforms the thermal material requirements compared to a traditional modular battery pack.

In a typical modular battery pack, the cells sit in a module with a thermal interface material (TIM), normally in the form of a dispensible gap filler. Another TIM is then used to make contact between the module and the cooling plate. In cell-to-pack, the cells can be directly connected to the cold plate. This reduces the number of thermal interfaces and hence a lower thermal conductivity TIM can be used. However, there is now a need for increased adhesion strength. The transition from modular batteries to cell-to-pack is also a transition from thermal gap fillers towards thermally conductive adhesives.

When it comes to fire protection, in a modular system, the modules can be insulated and protected. With cell-to-pack, it becomes more challenging to limit thermal runaway propagation across the battery. This presents more opportunities for propagation prevention materials between cells and for greater protection levels for the pack enclosure, inside and out. With little enforced regulation that is specific to thermal runaway, there remains a variety of suitable solutions such as powder coatings, intumescent coatings, ceramic materials, and aerogels.

IDTechEx’s report “Thermal Management for Electric Vehicles 2021-2031” details the OEM strategies, trends, and emerging alternatives around the thermal management of Li-ion batteries, electric traction motors, and power electronics with considerations for optimal operating temperature and fire protection.

The Hybrids Strike Back: Recent Sales Surges

Non-plug-in and plug-in hybrid sales have been surging over the past couple of years, with plug-in hybrid sales tripling year-on-year to over 600k vehicles in Europe alone in 2020.

At their worst, hybrids are an environmental con. They’re confusing for consumers: 48V mild hybrid, 48V full hybrid, full hybrid (high voltage), plug-in hybrid, non-plug-in hybrid. Proponents of each tend to claim theirs is a satisfactory solution to reducing on-road emissions, proclaiming long ranges and short charging times.

In the past, the Norwegian government outright banned misleading ‘self-charging’ HEV ads and the UK reduced then removed incentives for PHEVs because drivers weren’t plugging them in (behavior not just isolated to the UK.)

At their best, hybrids are a short-term transitional step towards zero-emission powertrains. An old narrative, but one now in full swing. Recent surges have been underpinned by Europe as automakers avoided fines set by the EU’s 95g CO2 per km target.

But the Death Star always gets blown up. And sales surges of hybrids will be short-lived. Battery electric vehicles are the easiest way to meet emissions targets and are in high demand, so will increasingly be prioritized. Over the summer, the Head of Development at Daimler Markus Schäfer was quoted saying “No further new [PHEV] developments are planned”.

Policymakers are also catching up with hybrids’ limitations, and it is being reflected in upcoming policy. Moreover, fossil fuel bans coming in between 2030 – 2040 tend to imply or explicitly include hybrid bans, although they are typically far out and deliberately unclear. Chile and Greece were the latest countries to join the club this year.

©Copyright MOTORING WORLD INTERNATIONAL.

All rights reserved. Materials, photographs, illustrations and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior written permission from Motoring World International

Contact: editor@motoringworldng.com