DR JAMES EDMONDSON

While the focus of the automotive market has been on electrification to meet CO2 regulations, these are not the only regulations that will significantly impact the automotive industry.

PFAS (per- and polyfluoroalkyl substances) are becoming a greater concern throughout multiple industries.

With the uncertainty around PFAS regulations, there are a few avenues that automotive players could pursue to replace the refrigerants they use.

IDTechEx’s latest report on the topic, “Thermal Management for Electric Vehicles 2025-2035: Materials, Markets, and Technologies”, predicts nearly 45 million kg of refrigerants will be required just for electric vehicles (EVs) by 2035. Therefore, changing refrigerants for the fleet would be a significant transition for the automotive market.

The story so far

Refrigerants are required for cars regardless of drivetrain, as they are used in the air conditioning system to maintain the temperature of the passenger cabin. In some EVs, like the early-to-market BMW i3 and the newer vehicles from BYD, refrigerant is used to cool the battery too.

R134a was the standard (replacing chlorofluorocarbons, CFCs), but in Europe, due to its high global warming potential (GWP), it was banned for vehicles on a new chassis manufactured after 2010 and in all new cars from 2017. Other regions like the US have followed suit, although R134a still finds significant use in places like China. R1234yf was the immediate replacement with a GWP of less than 4 in comparison to R134a at over 1400.

The definition of PFAS is rather broad, and the definition from the Organization of Economic Cooperation and Development encompasses nearly 5,000 unique chemicals. The concern with these substances is their persistence in humans, wildlife, and the environment. There is increasing evidence of potentially harmful effects, such as increased risk of cancer, developmental delays, and hormonal issues (per the US EPA and the OECD).

The definition of PFAS is rather broad, and the definition from the Organization of Economic Cooperation and Development encompasses nearly 5,000 unique chemicals. The concern with these substances is their persistence in humans, wildlife, and the environment. There is increasing evidence of potentially harmful effects, such as increased risk of cancer, developmental delays, and hormonal issues (per the US EPA and the OECD).

The European Union is considering a universal PFAS ban, as are several US states. If the EU decides to adopt the universal restriction, then it could take anywhere from 1.5 years to 6.5 years to 13.5 years to implement replacements, depending on whether refrigerants in cars receive a deferral. However, deferrals are only likely for applications where there are no commercial alternatives and/or alternatives need time to scale production. Although there is currently no clear timeline for enforcing R1234yf replacement, this hasn’t stopped the development of alternative refrigerants and their associated thermal management components.

Next gen refrigerants

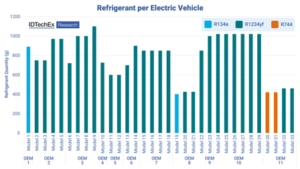

R744 (CO2) was first adopted by Mercedes in the S-Class in 2017, although it has since dropped this approach. VW’s ID EVs on the MEB platform use R744 in models that have a heat pump. R744, by definition, has a GWP of 1. It also has high efficiency in colder conditions and is relatively inexpensive, non-toxic, and non-flammable. However, R744 requires higher pressures to operate, making system design and safety more challenging. VW also includes CO2 sensors in the cabin for occupant safety. The other downside is poorer efficiency in hotter climates. Despite challenges, R744 is an alternative to R1234yf that has been deployed commercially, and in early 2024, VW announced its plans to convert all of its BEVs (battery electric vehicles) to R744 by 2030.

R290 (propane) is another potential alternative, with a GWP lower than 3 and no ozone depletion potential. It has better refrigeration capacity at high loads when compared to R744 and is also relatively inexpensive. It can also operate at a lower pressure, somewhat simplifying system design. The downsides include more challenges for heating in cold conditions, while the major roadblock is related to safety. Propane is highly flammable, and certain regions restrict the use of flammable refrigerants. Suppliers like Hanon Systems have presented R290 air conditioning systems, and ZF demonstrated a concept EV with R290 in 2023, with plans for deployment in 2026.

In addition to these two options, there have also been studies looking at blending R744 and R290 to overcome some of the limitations of each.

Outlook

While the regulations are yet to be defined around R1234yf, we could certainly expect to see bans implemented in the future. IDTechEx believes that R744 and R290 are the two most immediately viable alternatives and that R744 will be favored, at least initially, due to it being in the later stages of commercialization and having fewer safety concerns. However, there may be innovation required to improve its higher temperature performance to meet the needs of hot climates and thermally demanding fast charge scenarios.

IDTechEx has further discussion and forecasts of EV refrigerants in its “Thermal Management for Electric Vehicles 2025-2035: Materials, Markets, and Technologies” report, as well as a deep dive into PFAS compounds and their replacements in its report “Per- and Polyfluoroalkyl Substances (PFAS) 2024: Emerging Applications, Alternatives, Regulations”.

“Thermal Management for Electric Vehicles 2025-2035: Materials, Markets, and Technologies” looks at the thermal management of the battery, motors, power electronics, and cabin with a deep dive into strategies, components, materials, market shares, and forecasts to 2035.

Dr James Edmondson is a Research Director at IDTechEx

©Copyright MOTORING WORLD INTERNATIONAL. All rights reserved. Materials, photographs, illustrations and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior written permission from Motoring World International

Contact: editor@motoringworldng.com