JAMES EDMONDSON

The protection of electric vehicle (EV) batteries from thermal runaway and fire is an important topic. Safety is paramount for the automotive industry and regulations are starting to catch up, implementing escape times and other measures to improve safety.

The large variety in battery pack designs and OEM requirements has led to the adoption of many different types of materials to prevent or delay the propagation of thermal runaway. With the rapidly growing EV market, there is certainly a large opportunity to be had for material suppliers, with IDTechEx predicting a 16.3% CAGR for EV battery fire protection materials from 2023 to 2034.

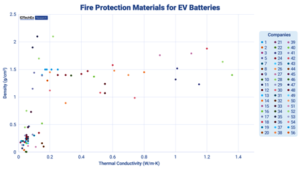

However, over the past couple of years, IDTechEx has seen a very large number of material suppliers entering this space. Some are repurposing existing materials, and some are making dedicated solutions. But at this stage, almost every major materials supplier has at least one option for a material that can be used for this application.

Findings from industry events

In January 2024, IDTechEx attended Automotive World 2024 in Tokyo, Japan. The event observed materials such as encapsulating foams from Dow and H.B. Fuller. While these have been primarily used for cylindrical cell systems, there are also opportunities for these to expand adoption to use between prismatic and pouch cells.

IDTechEx also saw Denka and Fujipoly exhibiting a fiberglass material with endothermic additives and a silicone rubber, respectively. Stanley Engineered Fastening is entering this space too; it showcased thermal fins, swelling compensators, and thermal barriers as part of its thermal management solution for EV battery packs.

Applications are not just between cells; Fujikura showed a graphite-based intumescent material that expanded to form a protective layer around the seal of a battery pack in the event of high temperatures.

At InterBattery 2024, IDTechEx observed players such as Shinsung C&T, Wacker, 3M, Alkegen, and Aspen Aerogels displaying materials that can aid in the fire safety of EV batteries. Aerogels are certainly a material with increased interest thanks to their low density and thermal conductivity; despite some historic challenges around dustiness and high costs, aerogels are starting to see increased adoption with players like Aspen and Alkegen. IDTechEx’s report, “Aerogels 2024-2034: Technologies, Markets and Players”, predicts the market for aerogels will exceed US$2.6 billion by 2034, a huge increase from its hundreds of millions today, largely driven by the EV battery sector.

It should be noted that the materials mentioned above are at various stages of commercialization, from development projects through to mass-produced materials, and this is just a small subset of the players on the market. In fact, IDTechEx’s database of materials now includes over 130 materials used for EV battery fire protection.

Challenges for material suppliers

One of the challenges material suppliers face is the supply chain; for example, some OEMs source battery modules already assembled from China or Korea, meaning the OEM has little impact on the materials used between cells, and a supplier may have to go directly to the battery manufacturer, although this situation appears to be changing with greater development of in-house OEM production.

Many OEMs also have strong existing relationships with material suppliers from other components, making entry for new players more challenging, especially if they are not used to the volumes required for the automotive industry.

Many OEMs also have strong existing relationships with material suppliers from other components, making entry for new players more challenging, especially if they are not used to the volumes required for the automotive industry.

Materials must balance properties such as thermal conductivity, density, thickness/volume, dielectric strength, maximum protection temperature, and, ultimately, cost. Due to the inherent pros and cons of each material, suppliers may find their portfolio more or less suited to various applications for the battery; for example, protection between cylindrical, prismatic, or pouch cells, module level protection, pack lid protection, busbar protection, seal protection, vent protection, or several others.

EV fire protection material opportunities

Despite the challenges, the rapidly growing EV market with an increased focus on fire safety presents good opportunities for many players to operate in this field. Cars are not the only market electrifying either, with sectors like micromobility, trucks, and buses also presenting strong growth in electrification, leading to opportunities outside of the automotive market. IDTechEx predicts that segments outside automotive will account for 19% of the revenue made by fire protection materials for on-road EV segments in 2034, a nearly 9-fold increase in its value today.

IDTechEx’s report “Fire Protection Materials for EV Batteries 2024-2034: Markets, Trends, and Forecasts” predicts the market share and growth for various categories of materials, including ceramic sheets, mica sheets, encapsulating foams, aerogels, coatings (fire retardant and intumescent), phase change materials, and others. The report considers upcoming regulations and the shifts in battery design, such as cell format, cell-to-pack, and more, to determine volume and value forecasts across on-road vehicle categories, including cars, vans, trucks, buses, 2-wheelers, 3-wheelers, and microcars.

Dr James Edmondson is a Research Director at IDTechEx

©Copyright MOTORING WORLD INTERNATIONAL. All rights reserved. Materials, photographs, illustrations and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior written permission from Motoring World International

Contact: editor@motoringworldng.com