As the automotive industry is undergoes a foundational shift toward Software-Defined Vehicles (SDVs), vehicle functionality, user experience, and monetization opportunities are increasingly governed by software rather than hardware.

Captured comprehensively in the latest IDTechEx report, “Software-Defined Vehicles, Connected Cars, and AI in Cars 2026-2036: Markets, Trends, and Forecasts“, this evolution, highlights how central compute and zonal platforms will redefine automotive competition, generating an estimated US$755 billion in hardware revenue by 2029.

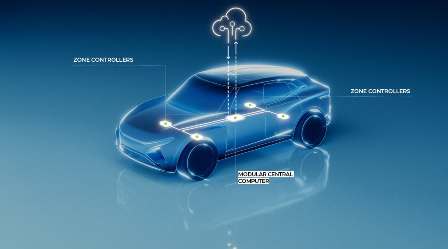

From Distributed ECUs to Central Compute + Zonal Architectures

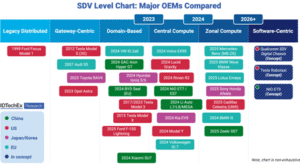

Today’s vehicles are moving beyond legacy ECU-based architectures interconnected by CAN and LIN networks, toward centralized computing models built around high-performance compute (HPC) nodes. Emerging central compute + zonal topologies, as exemplified by BMW’s upcoming Neue Klasse, Tesla’s refreshed Model Y, and Rivian’s next-gen vehicles, are driving this transformation forward.

The transition is propelled by bandwidth-intensive applications such as advanced driver assistance systems (ADAS), immersive infotainment, and AI-enabled cabins. Traditional CAN-FD networks capped at 8 Mbps are now inadequate, accelerating the adoption of 100 Mbps to gigabit automotive Ethernet with Time-Sensitive Networking (TSN). Simultaneously, automakers recognize significant economic and sustainability benefits: zonal wiring architectures reduce cable length by at least 30% and save kilograms of copper per vehicle.

The benefits of the zonal approach extend beyond bandwidth and weight. Abstracting physical I/O into logical services simplifies over-the-air (OTA) feature updates across sensors and actuators, while integrated solid-state power distribution supports 48 V architectures, eliminating heavy fuses and mechanical relays. Zonal controllers also streamline cybersecurity management, diagnostics, and future hardware expansions, consolidating multiple legacy gateways into fewer high-speed network trunks.

OEMs and Tech Giants Accelerate SDV Hardware Development

BMW is positioning its Neue Klasse platform at the forefront, collaborating with Qualcomm to integrate centralized compute nodes capable of supporting advanced driver assistance, rich infotainment, and dynamic feature monetization. Similarly, Tesla’s refreshed Model Y and Rivian’s forthcoming models leverage highly integrated central compute architectures, enhancing efficiency, performance, and scalability.

Leading Chinese OEMs, including BYD, NIO, and Li Auto, are rapidly deploying their own SDV solutions, emphasizing central computing and extensive OTA capabilities.

Leading Chinese OEMs, including BYD, NIO, and Li Auto, are rapidly deploying their own SDV solutions, emphasizing central computing and extensive OTA capabilities.

Meanwhile, tech giants such as Nvidia and Qualcomm provide critical hardware underpinning these developments, offering powerful, AI-optimized system-on-chip (SoC) solutions that enable real-time AI inference directly within the vehicle, fundamentally redefining user experience and vehicle interaction.

Monetization Shifts to Features-as-a-Service

SDVs enable automakers to explore innovative revenue streams through Features-as-a-Service (FaaS) and OTA monetization. Industry leaders including BMW, Mercedes-Benz, and Ford are already embedding monetizable functions such as advanced ADAS, infotainment subscriptions, and even seat heating into their SDV platforms, unlocking recurring revenues and enhancing customer retention. IDTechEx forecasts feature-based monetization revenues to experience substantial growth, achieving a 30–34% CAGR through 2035.

Connected Cars, AI-Enhanced Cabins, and Future Mobility

Connectivity remains integral to SDVs, with vehicle-to-everything (V2X) communication technologies like C-V2X and 5G enabling safer and more coordinated mobility ecosystems. Coupled with generative AI integration from Nvidia and Qualcomm, SDVs deliver adaptive, personalized user experiences through intelligent in-car assistants, immersive full-width displays, and customizable digital environments, setting new benchmarks for brand differentiation and user engagement.

Forecasts to 2036: SDV Market Acceleration

IDTechEx provides detailed 10-year forecasts (2026–2036), including global vehicle sales by SDV architecture levels, central and zonal compute platform revenues, and feature-related monetization.

“By 2029,” it predicts, “SDV platforms will generate US$755 billion in hardware revenue alone, underlining the rapid industry shift towards centralized compute architectures.”

©Copyright MOTORING WORLD INTERNATIONAL. All rights reserved. Materials, photographs, illustrations and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior written permission from Motoring World International

Contact: editor@motoringworldng.com