The lithium-ion batteries in electric vehicles (EVs) present very different material demands at the cell- and pack-level compared with the internal-combustion engine (ICE) vehicles they replace.

Whilst ICE drivetrains heavily rely on aluminum and steel alloys, Li-ion batteries utilize a lot of materials such as nickel, cobalt, lithium, copper, insulation, thermal interface materials, and much more at a cell- and pack-level.

The markets for these materials will see a rapid increase in demand that would not have been present without the take-off of electric vehicle markets.

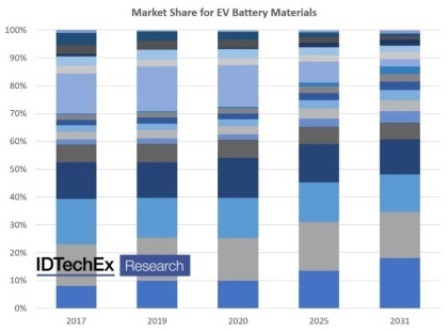

A new report from IDTechEx, “Materials for Electric Vehicle Battery Cells and Packs 2021-2031”, identifies and analyzes trends in the materials used for the assembly and production of battery cells and battery packs in the EV market. The report also provides granular market forecasts for over 20 key material categories in terms of demand in tonnes in addition to market value.

Battery Cell Materials

OEMs are changing the way they make batteries. Improvements to energy density are one key consideration but also the sustainability of the materials used.

Many materials involved have questionable mining practices or volatile supply chains. One such material is cobalt, which in addition to being very expensive, has its supply and mining confined mostly to China and the Democratic Republic of Congo.

As a result, OEMs are trending towards higher nickel cathode chemistries like NMC 622 or NMC 811 in some new models.

Up until 2018, the Chinese electric car market was predominately using LFP cathodes. This has now transitioned such that, as of 2019, only 3 % of cars utilized LFP batteries.

However, Tesla has now introduced the LFP Model 3 made in China, which could upset this trend. Additionally, LFP is used extensively for markets like Chinese electric buses. Despite the reduction in market share of materials like cobalt, the rapidly increasing market for electric vehicles will drive demand for cobalt and many other materials drastically higher over the next 10 years.

Battery Pack Materials

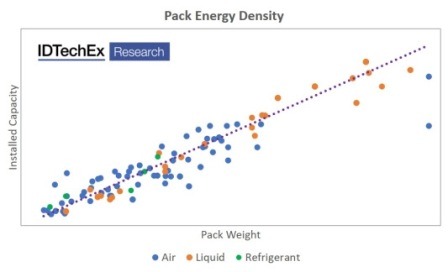

Whilst the energy density improvements of Li-ion cells might be the most prominent battery improvements in the public eye, we are also seeing an increase in pack-level energy density at a greater rate than just cell-level improvements.

Manufacturers are improving their battery designs; the mass of materials being used around the cells is steadily being reduced, allowing for a lighter battery pack or more cells to be used for the same mass. The choice of materials for several pack components also affects these improvements. More interest is being paid to composite enclosures for light-weighting, fire-retardant materials, thermal interface materials, and much more.

The thermal management strategy also impacts these choices. With increased energy density and consumer demand for fast charging, thermal management has to be more effective but also present a smaller and lighter package.

Several materials see a decrease in utilization per vehicle, but this is often overshadowed by the rapidly growing market for EVs.

In the report “Materials for EV Battery Cells and Packs 2021-2031”, an extensive database collated by IDTechEx of over 300 battery-electric and plug-in hybrid passenger car variants is used to determine trends in the battery cell and pack energy density, energy capacity, cell geometry, cell chemistry, and thermal management strategy, leading to a comprehensive set of material demands and market value forecasts.

©Copyright MOTORING WORLD INTERNATIONAL.

All rights reserved. Materials, photographs, illustrations and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior written permission from Motoring World International

Contact: editor@motoringworldng.com