The race to decarbonize on-road vehicles is undoubtedly being led by Battery Electric Vehicles (BEVs).

However, serious concern remains around whether BEV solutions can deliver the necessary duty cycle for those use cases that require significant range, brief downtime, and high operational flexibility. Examples are long-haul trucking and high mileage city bus operations.

In such applications, a huge 500+ kWh battery will be required to reliably deliver 350+ km of range on a single charge. And full recharging, even with 350kW ultra-fast chargers, will take hours. This becomes an even greater challenge in a depot situation, where megawatts of power are required.

Hyundai’s XCIENT fuel cell heavy-duty truck delivers ~400km of range, with a 73kWh Li-ion battery and hydrogen fuel cell system, requiring less than 20 minutes to refuel.

The growing momentum pushing a rapid transition to zero-emission vehicles, combined with a genuine need for range comparable to diesel powertrains and quick refueling, means massive automotive players like Toyota, Hyundai, GM, and Daimler are continuing to pump millions into improving fuel cell system technology and bringing down costs.

Major automotive markets including Japan, Korea, China, Germany, and California are planning for the significant deployment of fuel cell vehicles (FCEV). Germany has already built around 100 hydrogen refueling stations (HRS), offering a capacity to support 40,000 passenger cars, though their current fleet is less than 1,000.

Germany is providing a test-bed for FCEV in Europe and will challenge the assertion that the lack of hydrogen infrastructure is to blame for the lack of FCEV uptake. Relatively small fleets of heavy-duty FCEV could provide sufficient hydrogen demand to viably operate an HRS.

Versus cars, the value proposition for fuel cell trucks and buses is stronger. And IDTechEx says it does not expect fuel cell cars to be a commercial success comparative to battery-electric ones (see the previous IDTechEx article, Fuel Cell Cars: A Commercial Failure).

However, as forecasted by IDTechEx, the scale of the car market and substantial support for the development of a wider hydrogen economy by governments and companies in key regions mean that, in 2042, 60.3% of on-road FCEV market revenue will be from the passenger car market.

“Fuel cell makers,” it reckons, “will benefit from the volume of the car market to drive down costs for other sectors where the technology is more critical.”

Indeed, FCEV deployment faces considerable challenges, including decreasing the cost of fuel cell system components to reduce the upfront vehicle cost, whilst rolling out sufficient hydrogen refueling infrastructure to make driving an FCEV viable.

Also essential to the legitimacy of FCEV as a low carbon emission solution will be the availability of cheap ‘green’ hydrogen, produced by the electrolysis of water using renewable electricity, which analysis in the IDTechEx report highlights, will be vital to FCEVs delivering the environmental credentials on which they are being sold.

Also essential to the legitimacy of FCEV as a low carbon emission solution will be the availability of cheap ‘green’ hydrogen, produced by the electrolysis of water using renewable electricity, which analysis in the IDTechEx report highlights, will be vital to FCEVs delivering the environmental credentials on which they are being sold.

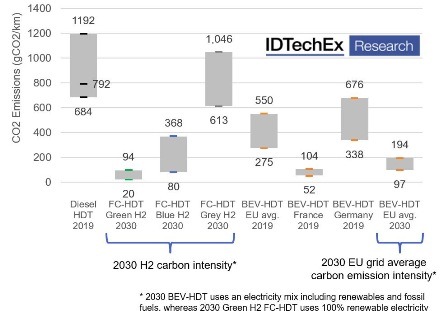

Cheap grey hydrogen generated from fossil fuels makes little sense as a low emission transport fuel, because the well-to-wheel emission footprint of an FCEV using grey H2 offers only a marginal CO2 saving versus modern diesel vehicles.

The new IDTechEx report, “Fuel Cell Electric Vehicles 2022-2042”, explores the current state of fuel cell vehicle development for passenger cars, light commercial vehicles, trucks, and city buses. The report discusses the technical and economic aspects of fuel cell deployment in these different transport applications and presents IDTechEx’s independent 20-year outlook for the future of fuel cell vehicles.

This report is part of IDTechEx’s broader mobility research portfolio, tracking the adoption of electric vehicles, battery trends, autonomy, and demand across land, sea, and air.

©Copyright MOTORING WORLD INTERNATIONAL.

All rights reserved. Materials, photographs, illustrations and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior written permission from Motoring World International

Contact: editor@motoringworldng.com