When talking about the electric vehicle (EV) market, a great amount of emphasis is placed on the battery cells. And it is rightly so. They govern the total storage capacity, impact energy density, and are a critical supply chain consideration when scaling up to meet the growing EV demand.

However, EVs present a great range of opportunities outside of the battery cells. The cells are packaged together into a pack that contains a plethora of materials and components. These include thermal interface materials (TIMs), fire safety, enclosures, insulation, compression foams, and many more.

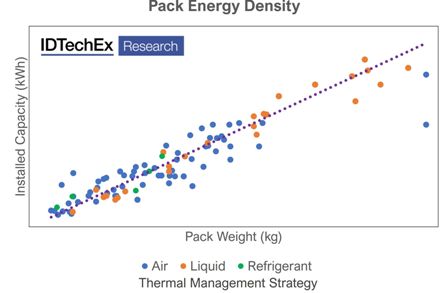

The cells are crucial to overall battery energy density. But the pack design is also a critical contributor. An increase in pack-level energy density is being seen, which is greater than just the cell improvement.

In 2020, the average pack energy density was 30% higher than 3 years prior. Whilst progress in this field has been gradually plateauing, the development of cell-to-pack designs and structural batteries will reinvigorate the trend and impact several of the materials used within the battery pack.

In 2020, the average pack energy density was 30% higher than 3 years prior. Whilst progress in this field has been gradually plateauing, the development of cell-to-pack designs and structural batteries will reinvigorate the trend and impact several of the materials used within the battery pack.

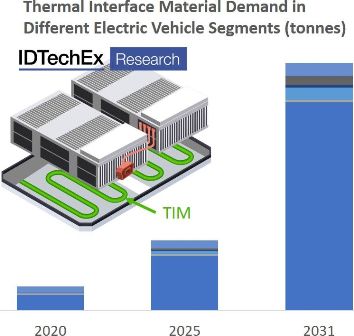

One example would be the use of gap filler TIMs. Many current pack designs utilizing modules will use gap filler TIMs to help transfer heat from the cells to a cold plate, with liters of TIM used per pack.

During the transition to cell-to-pack designs, the emphasis shifts towards thermally conductive adhesives to directly bond the cells to the cold plate, these adhesives have very different material property considerations.

IDTechEx research firm has extensive research in TIMs with its report on Thermal Interface Materials, which includes an in-depth look at the EV market and other industries such as 5G, LEDs, data centers, and consumer electronics. The firm expects that EVs will be the largest volume demands for TIMs by the end of the decade.

Another key trend has been the news around EV battery fires. Whilst recent recalls from GM and Hyundai have been related to cell manufacturing defects, thermal runaway is always a non-zero risk for Li-ion batteries.

Combustion engine vehicles also catch fire. And EVs, on a milage basis, catch fire less often. However, with an EV, the fire is typically much more significant in terms of the volatility but also with news coverage, potentially harming EV adoption.

New regulations have been adopted in China relating to thermal runaway and the necessary warning period for vehicle occupants and IDTechEx expect similar regulations to follow in other regions. This leads to opportunities for fire protection materials such as ceramic films, aerogels, and intumescent coatings to name a few.

IDTechEx expects a 10 fold increase in demand for fire protection materials in 2031 compared to today’s value.

In addition to the components discussed above, there is also great interest in composite enclosures to further reduce weight and materials that sit between or around the cells like insulating compression foams or heat spreaders. IDTechEx has published a report on Materials for EV Battery Cells and Packs which covers the use of the previously discussed materials as well as demand for inter-cell materials, enclosures, thermal management and the raw material demands for battery cells. Despite cell-to-pack trends reducing the material intensity per vehicle in many cases, IDTechEx predicts a 7 fold increase in battery pack materials outside the cells in 2031 compared to 2021’s value.

It has become well accepted that EVs will play a major role in the future of transportation and rely on many different materials for the combustion engine vehicles they replace.

It has become well accepted that EVs will play a major role in the future of transportation and rely on many different materials for the combustion engine vehicles they replace.

Now is the time to prioritize material developments and strategies to take advantage of this rapidly growing market.

These reports forms part of the broader electric vehicle and energy storage research from IDTechEx, who track the adoption of electric vehicles, battery trends, and demand across more than 100 different mobility sectors.

©Copyright MOTORING WORLD INTERNATIONAL.

All rights reserved. Materials, photographs, illustrations and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior written permission from Motoring World International

Contact: [email protected]